Navigating the AML regulatory changes: Elevating the Compliance

Navigating the AML regulatory changes: Elevating the Compliance

AML regulations keep evolving. Authorities update them to factor in the changes in international AML requirements and newer sophisticated methods invented by criminals to launder funds or conduct any other financial crime. For you, as a business entity subject to the AML regime in Singapore, there are things to keep in mind while adopting the AML regulatory changes.

Advancements in the business landscape and related operational threats also play a role. All these changes make it crucial for you to navigate the AML compliance updates effectively and implement the best practices in your entity. These facilitate your efforts in ensuring AML compliance with new regulations and amendments.

This blog explores the best practices to manage these AML compliance changes to enhance your business’s AML compliance program in line with Singapore’s regulatory landscape.

AML landscape in Singapore

Singapore is a well-known international financial center. It deals in many trading transactions, international businesses, and money transfers. These characteristics increase its vulnerability to money laundering and other financial crimes. To detect and prevent such illicit activities and strengthen entities’ defences, regulatory bodies like the Monetary Authority of Singapore (MAS), the Ministry of Law, Accounting and Corporate Regulatory Authority (ACRA), etc. have prioritised AML.

It aligns with global efforts towards developing and implementing measures against financial crimes. MAS, ACRA, etc., motivate the regulated entities to create an AML culture. It enables the development of robust controls against these risks. It releases circulars, rules, and notifications for AML/CFT compliance procedures. These AML guidelines teach you about emerging risks, best practices, and industry red flags.

With such sustained effort and innovative practices, AML supervisory bodies of Singapore commit to preventing financial crimes. Even the entities have taken strong measures to manage these risks and minimise their impact. The aim is to free Singapore’s financial system from money laundering threats.

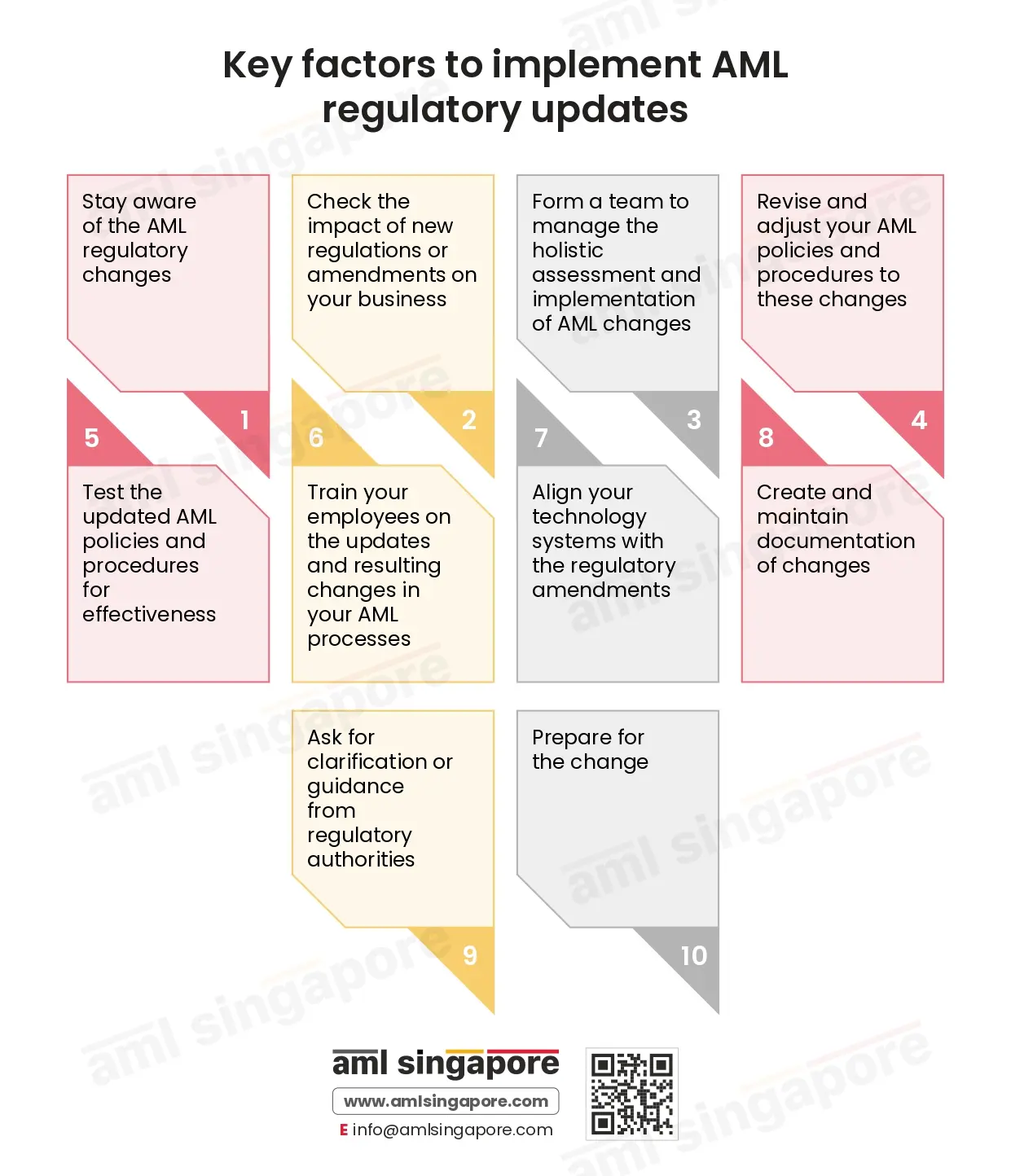

Things to keep in mind while adopting AML regulatory changes

You must remember the following things while ensuring AML compliance with new AML regulations or amendments to the existing AML compliance framework:

Stay aware of the AML regulatory changes

Awareness of new laws and amendments is essential to see their impact on your business. Stay up-to-date on the changes in regulations or the introduction of new laws. You can set up a robust system to track these changes, such as subscribing to the relevant authorities’ websites for updates or subscribing to any paid database that triggers the notification for any regulatory updates to the local regulations or international standards. Also, have employees monitor these amendments to avoid missing any.

The regulatory amendments primarily impact the AML processes, policies, and controls. So, you must be aware of these changes to incorporate into your internal policies, procedures and controls (IPPC) and implement them across the organisation.

Check the impact of new regulations or amendments on your business

The regulations and laws are the main bases for creating your AML framework. With minor changes in them, your policies and procedures will also change. So, knowledge of the impact of the regulatory changes is critical.

Assess the impact of regulatory changes on your business operations. You might not be able to amend your policies and processes unless you analyse the effects of the legal changes on your business profile. So, understand the regulatory changes. Identify what changes it has led to in your operations and AML efforts.

This analysis will help you decide on the necessary actions and resources to adjust to the regulatory changes.

Check the impact as soon as the amendments come into force so you do not miss the bus. There might be deadlines, new reports to submit, or procedural adjustments. Any delay in these would affect your final AML compliance. So, a timely and accurate evaluation of implications is necessary for ensuring AML compliance with new regulations or amendments to the existing AML laws.

Form a team to manage the holistic assessment and implementation of AML changes

Regulatory changes mean that you need to modify your AML framework. And you can’t do it alone. To achieve comprehensive compliance, you must understand the impact and amend the AML/CFT framework (policies, procedures, controls, and systems). To facilitate this, you need a team. A team to apply AML compliance updates adequately, following the best practices.

So, create a team that adjusts your AML framework to the regulatory changes. Your team must have risk management, compliance, IT, and legal. They must deeply understand existing AML laws and the new regulations. Only with such diversified expertise can you manage to make effective changes.

If required, involve the relevant stakeholders from the business operations and the senior management to adopt the changes entirely and accurately.

Revise and adjust your AML policies and procedures to these changes

A key thing to keep in mind is making the related changes in your AML framework per the regulations.

Regulatory authorities amend existing regulations if they are not making a difference. Or they bring in new laws to make up for the deficiencies in existing laws. So, following the changes and new rules becomes your legal obligation.

You must review your existing AML policies, procedures, and controls. See where you can find loopholes or gaps. Fill those gaps or deficiencies with new rules or amendments. Alter these AML measures and initiatives to align them with the new regulations. Make necessary adjustments to ensure AML compliance with new or amended AML regulations.

Test the updated AML policies and procedures for effectiveness

You have made the changes in your AML framework per the new regulations in Singapore. But is it working as expected? Are you able to achieve your AML compliance goals? Is your updated program capable enough to prevent money laundering activities and transactions?

You can get answers to these questions only with proper testing and validation of your updated AML policies, procedures, and controls. You must detect if the updates and modifications ensure compliance with new regulations. If not, that means there are still gaps in your framework. If yes, that means the changes to AML regulations are compelling enough.

If you miss this testing and conformity, your AML/CFT framework will still have issues. Thus, you may still be vulnerable to the ML/TF risk despite deploying the controls. These robust monitoring mechanisms enable prompt action on deviations and inaccuracies.

Train your employees on the updates and resulting changes in your AML processes

Who will make these changes in AML processes? Who will execute the new procedures and controls? It’s the employees. That is why they must know about the new updates and have relevant training.

With minor changes in laws, employees’ roles and responsibilities may change. Their procedures to complete an AML task alter. So, employees must also know the new procedures and methods to complete their jobs. You must train your employees to fathom and adapt to these AML updates.

Communicate to them about the new regulations. Solve their doubts, answer their queries, and clarify every minor AML task that would be executed in an altered manner. Such comprehensive, change-specific training is a crucial thing to keep in mind while applying AML regulatory changes.

Align your technology systems with the regulatory amendments

Create and maintain documentation of changes

When you created the AML framework for your business, you recorded it. When you make changes to it, document the amendments as well.

You must create and maintain records of:

- Changes in regulations

- Resulting amendments to the AML framework

- Impact on the AML compliance status and ML/TF risks to your business

Such comprehensive records are helpful during audits or authorities’ investigations. The authorities might ask for any of these records at any time. So, you must maintain clear and accurate documentation around the mechanism and the best practices followed for updating your AML compliance framework.

Ask for clarification or guidance from regulatory authorities

While applying AML regulatory changes, one thing to remember is clarity on the needed modifications. You must have an active and open communication channel with regulators.

Seek guidance from the regulatory authorities whenever and wherever needed. Get your doubts clarified on the implications of a regulation to your industry vertical. You can be accurate in your AML compliance only with the correct understanding of the purpose of bringing the changes to the regulation.

To foster such a relationship, show your commitment to compliance. Prove that you are ready to take every action to prevent ML and TF threats. This shows your dedication to the purpose of AML for the security of the country’s financial system.

Prepare for the change

One of the things to keep in mind while applying AML regulatory changes is that change is imminent. So, you must be ready for it. It mustn’t come as a surprise to you.

Prepare the business and employees for it. Distribute enough budget for it. While preparing the project schedules, keep aside time to implement and adopt these changes.

Your employees must not be adamant about not learning the new AML procedures. Train your employees in change management. Motivate them to accept and agree to the changes in AML policies. Teach them the Dos and Don’ts to avoid any possible negligence. It is possible to bring the modifications into effect only with their readiness.

These are the key considerations to keep in mind while applying AML regulatory changes in your business’s AML/CFT compliance program. Missing any one or more of these might affect your AML compliance efforts. Ticking the boxes or maintaining a checklist is fine. But what you need is implementation not on paper but in practice. So, ensure that the changes align with your goals and are effective for operations.

AML Singapore – your partner for professional AML consulting services

AML Singapore is a leading player in AML compliance for regulated entities in Singapore. We help you navigate AML regulations and their amendments successfully. We create a robust plan to study the impact of the changes and apply them.

We commit to continuous improvement in AML efforts. You can expect our experts’ hands-on response to evolving regulations. Connect with our team to receive continued quality AML compliance services and build resilience.

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 26 years of experience in governance, risk, and compliance. He helps companies with end-to-end AML compliance services, from conducting Enterprise- Wide Risk Assessments to implementing the robust AML Compliance framework. He has played a pivotal role as a functional expert in developing and implementing RegTech solutions for streamlined compliance.