Employee Due Diligence: A Crucial Element of Internal AML Framework

Employee Due Diligence: A Crucial Element of Internal AML Framework

What is Employee Due Diligence under AML?

Employee Due Diligence is not merely restricted to understanding the person’s qualifications and collecting the identity document. Rather, it is a comprehensive exercise involving thorough identification and verification of the employee’s identity, financial background, and professional and criminal history. It also includes obtaining information about employee’s past conduct and attitude towards the organization, compliance, etc. Employee Due Diligence also includes screening the person against sanctions, adverse media, and the global Politically Exposed Person (PEP) database to identify any connection with the designated person or a PEP or negative news.

Employee Due Diligence is necessary for new employees before they are onboarded and for the existing workforce before the change in job profile or promotion. This shall empower the entity to ensure that no employee exploits the offered position to harm the business or adversely impact the entity’s compliance forces.

This comprehensive scrutiny of the employee shall assist the regulated entity in identifying the red flags – general and related to AML compliance – beforehand.

Let’s not limit ourselves to this and explore the importance of Employee Due Diligence.

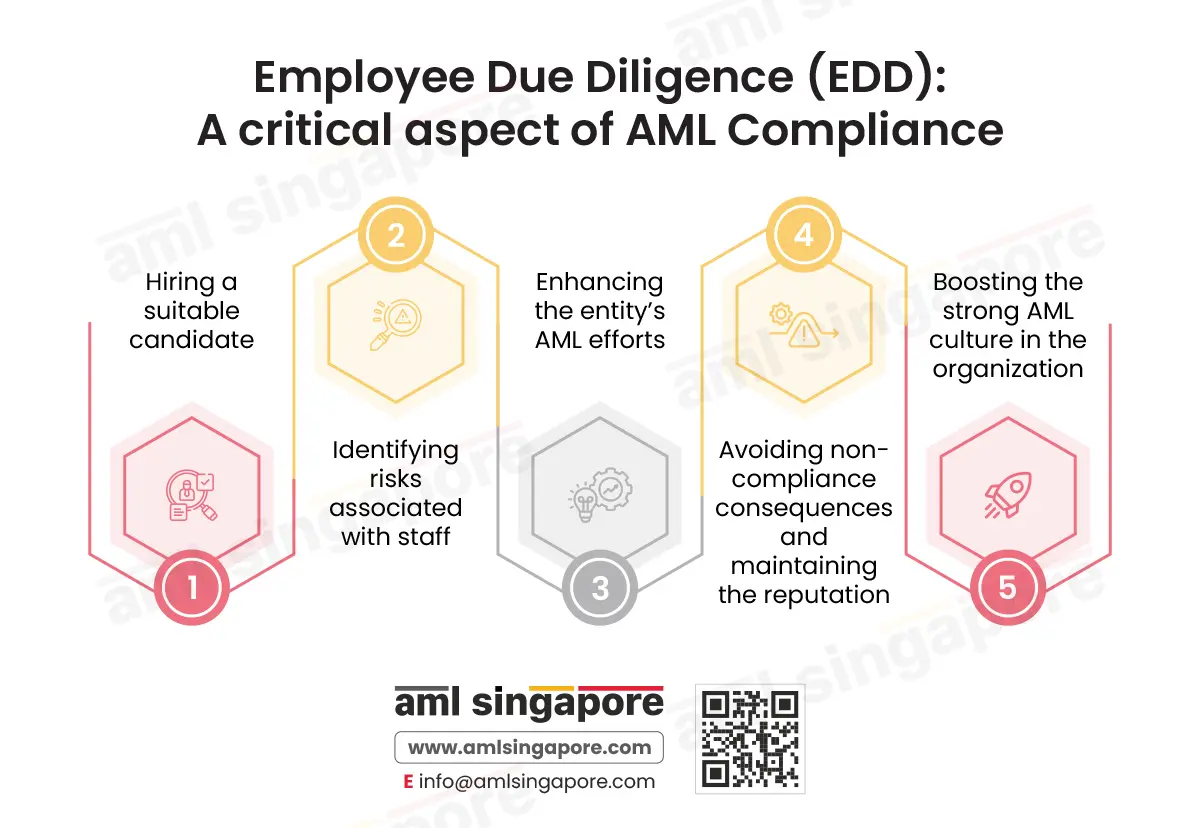

Why is Employee Due Diligence a critical aspect of AML Compliance?

Hiring a suitable candidate

Having conducted background verification and understood the person’s approach to work, compliance, motivations, etc., the regulated entity can make an informed hiring decision. This will ensure that the right person is in the proper job role, including the AML compliance function.

Hiring the wrong individual can expose the business to legal consequences and damage the morale of other staff members, impacting the overall work environment.

Identifying risks associated with staff

Employees generally have access to necessary resources and business-sensitive information. It is essential to identify the possible risks that employees may pose around the exploitation of confidential data, misuse of business funds, tweaking the controls to help criminals surpass the business with their criminal activities, etc. Employee Due Diligence offers perceptions into the individual’s integrity, trustworthiness, and ability to discharge professional obligations diligently.

Further, it can also give insights into the person’s skills to identify and manage the conflict of interest between business and compliance.

The process shall ensure that no person with a questionable background gets access to the business.

Enhancing the entity’s AML efforts

Avoiding non-compliance consequences and maintaining the reputation

As mentioned above, the AML regulations of Singapore require the Financial Institutions and the Designated Non-Financial Businesses and Professions (DNFBPs) to screen their staff as part of the internal money laundering and terrorism financing risk management framework. Failure to comply with this mandatory obligation may result in severe fines and reputational damage. When a vigorous Employee Due Diligence program is established and followed by the entity, it indicates the commitment to fight financial crimes and maintain financial integrity, creating a positive image amongst the stakeholders, customers and authorities increasing the brand image in the market.

Boosting the strong AML culture in the organization

Employee Due Diligence demonstrates how high the entity places the AML efforts and compliance. With this example, the new and existing employees recognize the significance of AML measures and wholeheartedly contribute towards complying with the AML landscape and protecting the business. It also enhances employee engagement in the AML functions, resulting in better compliance across all the business areas, leaving no gaps for criminals to exploit the business.

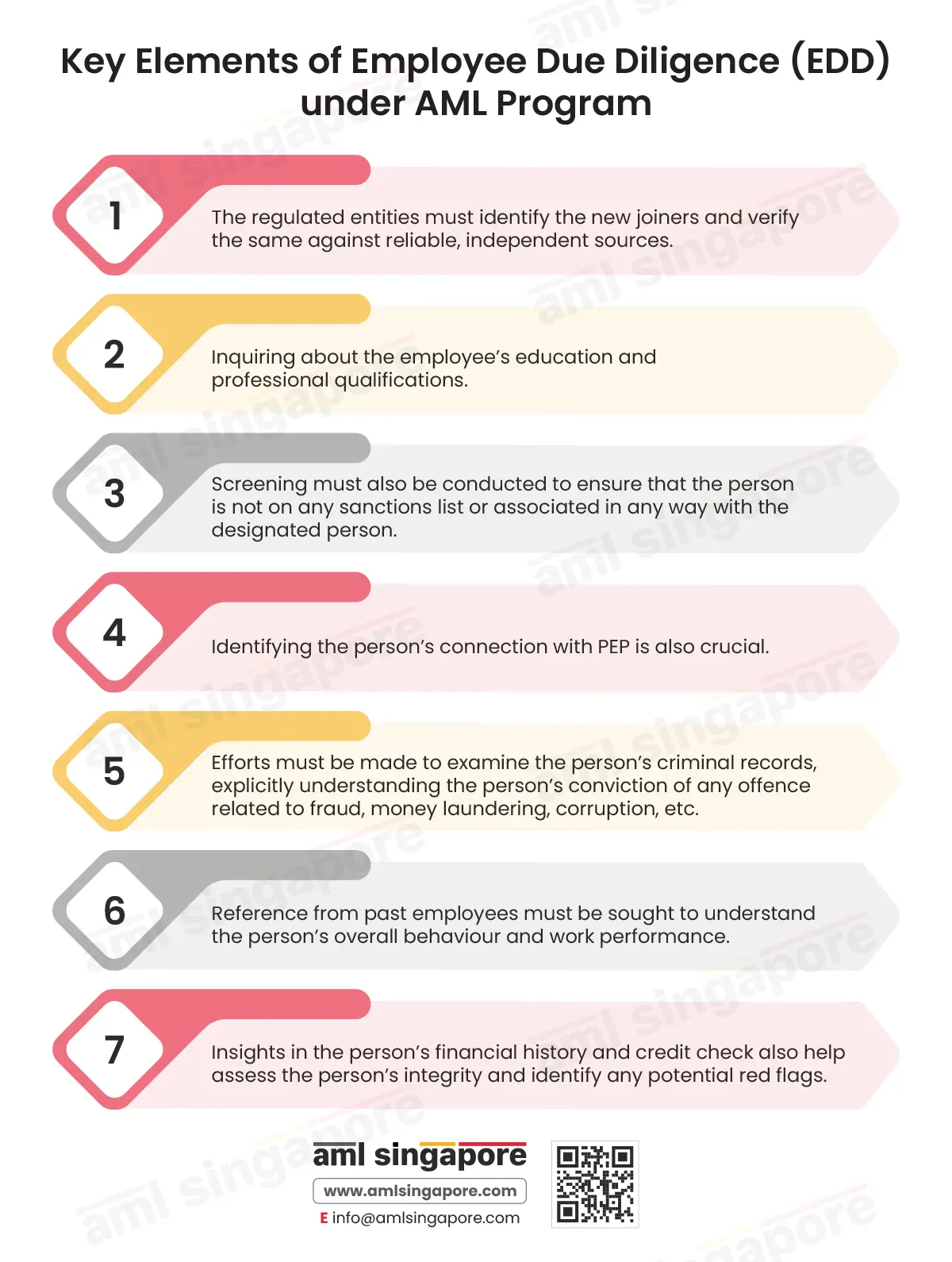

What are the key elements of Employee Due Diligence under the AML Program?

Employee Due Diligence is not a namesake process. The regulated entities must adopt the following approach to perform Employee Due Diligence systematically:

- The regulated entities must identify the new joiners and verify the same against reliable, independent sources.

- Inquiring about the employee’s education and professional qualifications.

- Screening must also be conducted to ensure that the person is not on any sanctions list or associated in any way with the designated person.

- Identifying the person’s connection with PEP is also crucial.

- Efforts must be made to examine the person’s criminal records, explicitly understanding the person’s conviction of any offence related to fraud, money laundering, corruption, etc.

- Reference from past employees must be sought to understand the person’s overall behaviour and work performance.

- Insights in the person’s financial history and credit check also help assess the person’s integrity and identify any potential red flags.

The above measures can be complemented by an undertaking of a declaration by the employee to the effect of his identification, criminal conviction and financial profile. The regulated entity may appoint third-party professionals to run these checks on the employees and furnish an independent report if necessary.

It is important to note that the Employee Due Diligence process does not end here. It is an ongoing activity necessary to ensure that staff do not pose any risk or obstruct the business or its efforts to combat financial crime.

With a detailed vetting of the individual’s profile, the entity ensures that they appoint people with clean backgrounds and positive attitudes towards profession and AML compliance.

How can AML Singapore assist you in managing Employee Due Diligence?

AML Singapore can assist you in assessing the business exposure to financial crime and customizing the Internal AML Policies, Procedures, and Controls (IPPC). This AML framework would be comprehensive, covering Customer Due Diligence and a robust Employee Due Diligence program, highlighting the measures to be adopted for staff screening. We can also help with managed due diligence support, offering thorough risk assessment and recommendations of mitigation measures.

Let’s build a competent workforce with Employee Due Diligence!

About the Author

Jyoti Maheshwari

CAMS, ACA

Jyoti has over 9 years of hands-on experience in regulatory compliance, policymaking, risk management, technology consultancy, and implementation. She holds vast experience with Anti-Money Laundering rules and regulations and helps companies deploy adequate mitigation measures and comply with legal requirements. Jyoti has been instrumental in optimizing business processes, documenting business requirements, preparing FRD, BRD, and SRS, and implementing IT solutions.