Must-Have Elements of AML Program

Must-Have Elements of AML Program

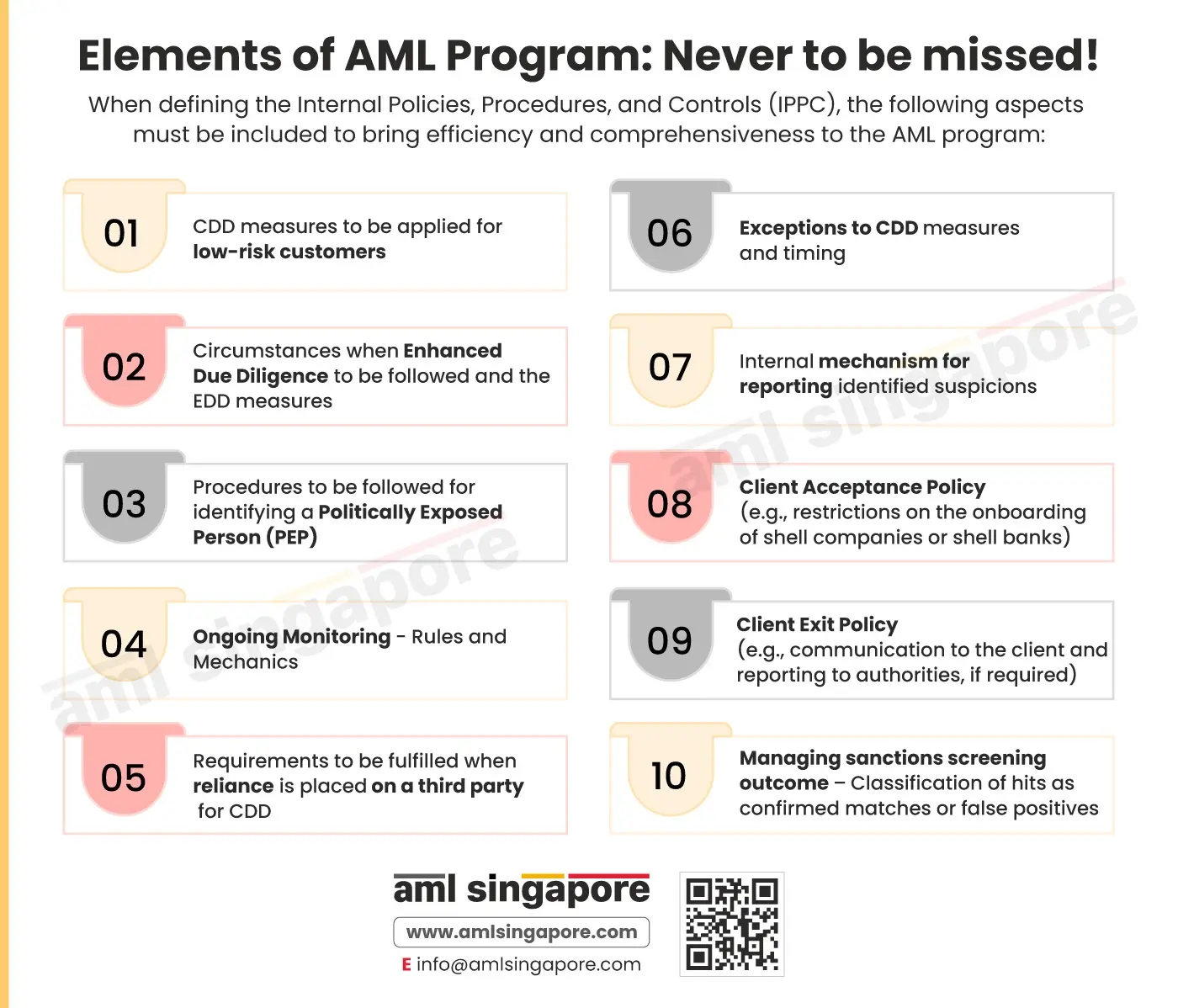

The AML regulations in Singapore mandate the regulated entities to develop Internal Policies, Procedures and Controls (IPPC) to identify and manage the financial crime risk. When developing this IPPC, aspects like Enterprise-Wide Risk Assessment, Customer Due Diligence process, Record Keeping requirements, reporting of suspicious transactions to the authorities, etc. must be included.

However, when documenting these key concepts, sometimes, the entity may miss on emphasizing the crucial elements necessary to implement these core AML measures in its true spirit. The infographic here highlights some of the aspects that must be well considered and documented in the entity’s AML Program, such as:

- When defining the Customer Due Diligence process, the entity must give specific attention to scenarios when the risk classified could be “low” and what measures would be adopted for such customers.

- CDD must also provide for the circumstances when the business relationships shall be considered as posing a “high” risk warranting application of Enhanced Due Diligence and what checks and measures would be implemented during EDD.

- A specific reference should be made to the entity’s approach and process for identifying the Politically Exposed Persons (PEP).

- The exceptional scenario where any relaxation to the normal CDD process is permitted must also be clarified (exceptions to the CDD process).

- No CDD cycle is complete without ongoing monitoring. The AML Program must capture details about the entity’s rules, methodology and system for continuously monitoring transactions and business relationships.

- In case the entity is considering the option of relying on a third party for conducting CDD on its behalf, then the entity’s approach to onboarding this party and the degree of reliance to be placed must be well defined. The requirement related to service level agreement must also be documented.

- To ensure that no red flags go undetected or unreported, the AML Program must define the internal procedures and mechanism for reporting suspicious transactions. This shall empower the team to report the risk indicators to the AML Compliance Officer timely.

- Customer Acceptance and Exit Policy must also be part of the entity’s overall AML Program, capturing the conditions that must be fulfilled to onboard a customer and the actionable expected for smooth customer exits.

- The AML Program is incomplete without mention of the Sanction Implementation framework. This should also include the entity’s approach towards handling the screening results and complying with sanctions regulations.

The components shall assist the regulated entities in developing a foolproof and comprehensive AML program, ensuring no stone is unturned in managing the risk and AML compliance simultaneously.

Let AML Singapore assist you in developing your IPPC, aligned with the assessed business exposure to financial crimes and applicable AML regulatory landscape. You focus on your business while we handhold you in your AML ride.