Developing a robust AML Model to fight Financial Crimes

Developing a robust AML Model to fight Financial Crimes

The AML regulations in Singapore mandate the regulated entities to develop and maintain a comprehensive AML program for identifying and reporting suspicious transactions indicating money laundering or other financial crimes.

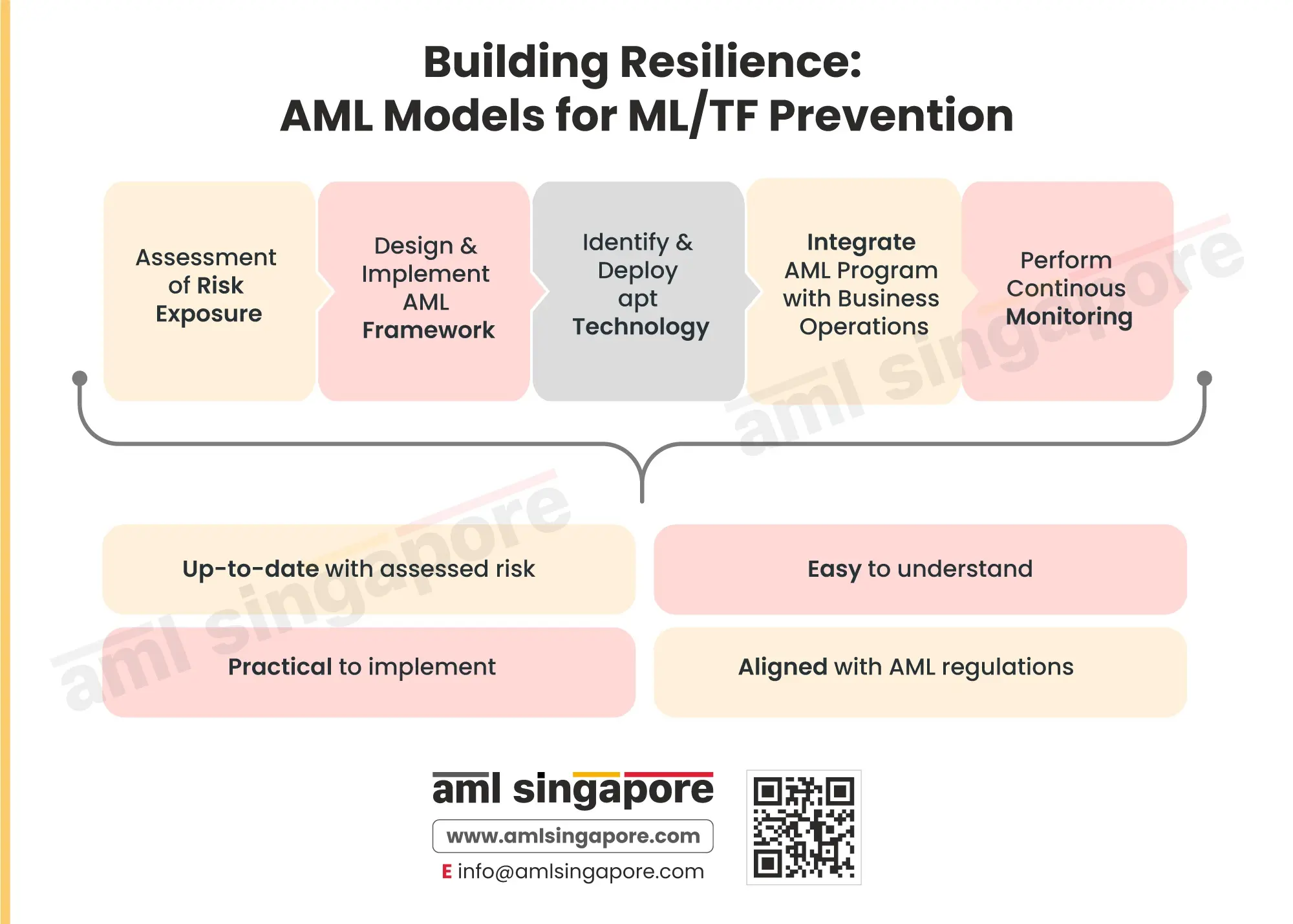

An apt AML model must be adapted to the risk exposure of the entity. The regulated entities must conduct an Enterprise-Wide Risk Assessment (EWRA) to determine the ML/FT vulnerabilities the business may face. The outcome of this risk assessment must be used to develop the personalized AML/CFT Internal Policies, Procedures, and Controls (IPPC) for the regulated entity. Once the AML framework is designed, the entity must identify and deploy the right AML tools and techniques that support the regulated entity’s AML goals.

Understanding and appreciating that the AML function cannot work in silos is essential. For the effectiveness of the AML measures, the same must be seamlessly integrated into the entity’s routine business operations, from customer onboarding to execution of transactions to clearance of the outstanding receivables.

Once the AML Model is implemented, the regulated entity must regularly review and update the program to ensure its quality and relevance to the entity’s financial crime risks.

To yield the desired result of combating ML/FT and staying regulatory compliant, an ideal AML Model must, at all times, be aligned with the entity’s risk exposure and the applicable AML regulations (Act, Rules and Regulations, and the Guidelines issued by the concerned supervisory authorities). Further, the IPPC designed for AML compliance must be easy to understand and practical to implement, which can be adhered to by the employees across the organization during their day-to-day activities.

Here is an infographic discussing the key components and characteristics of the best AML Model for preventing money laundering and terrorism financing.

Let AML Singapore assist you in developing a robust and comprehensive AML model to safeguard your business and comply with Singapore’s AML laws. Not just developing, AML Singapore helps in implementing the AML program accurately with staff training and complete handholding throughout the AML compliance journey.