Measures when CDD cannot be completed under Singapore AML Laws

Measures when CDD cannot be completed under Singapore AML Laws

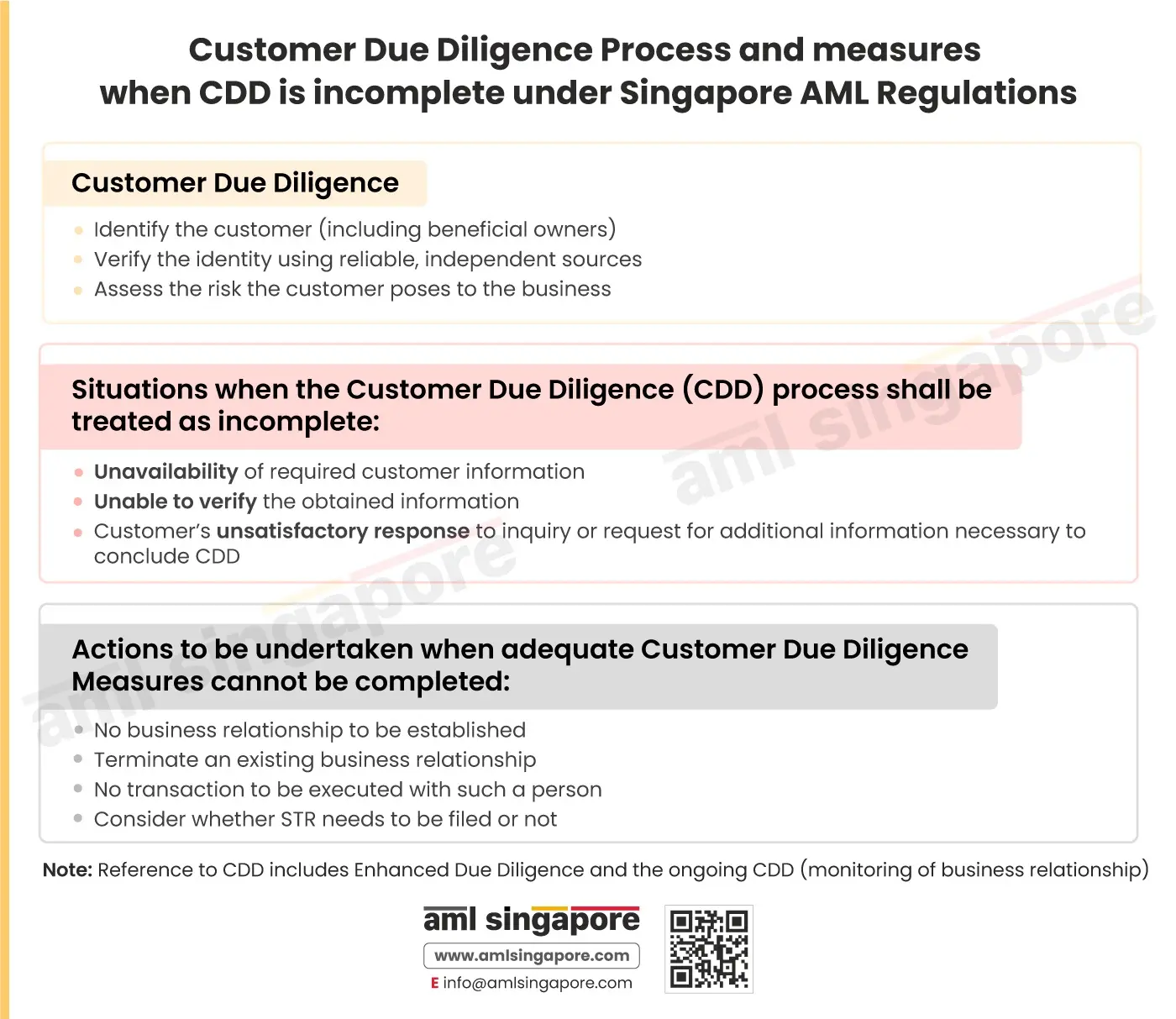

The Singapore AML Regulations mandate regulated organizations to adopt adequate Customer Due Diligence (CDD) measures when establishing a business relationship. This CDD process includes identifying the customer and their beneficial owners, verifying their identity, and assessing the financial crime risk they pose to the business.

Satisfactory completion of the CDD is a mandatory element of the AML Compliance Program to assess and manage the ML/FT risks the customer or business relationship exposes to the business.

However, there may be circumstances when the regulated entities cannot successfully conclude the customer identification and verification process. Such cases may include situations when the customer does not share valid identity proof, or other key identifiers are missing. This would result in the non-completion of the CDD measures.

The Singapore AML regulations mention that the regulated entities – whether a Financial Institution or a DNFBP – must not onboard or establish a business relationship with a person when the CDD measures are not adequately performed.

For existing customers, the ongoing CDD measures cannot be appropriately applied; the regulated entities must terminate such business relationships and refrain from executing further transactions unless the CDD process is complete.

Further, in such cases of incomplete CDD measures, the regulated entities must consider the need to report the person by filing the Suspicious Transaction Report on SONAR.

Here is an infographic discussing Customer Due Diligence, circumstances when the CDD process would be tantamount to being incomplete, and actions expected of the regulated entities when the CDD is not concluded.

Let AML Singapore assist you in defining your customer onboarding process with robust Customer Due Diligence measures, Customer Acceptance, and Exit Policy, to manage your ML/FT risks.