Enterprise-Wide Risk Assessment under Singapore AML Regulations

Enterprise-Wide Risk Assessment under Singapore AML Regulations

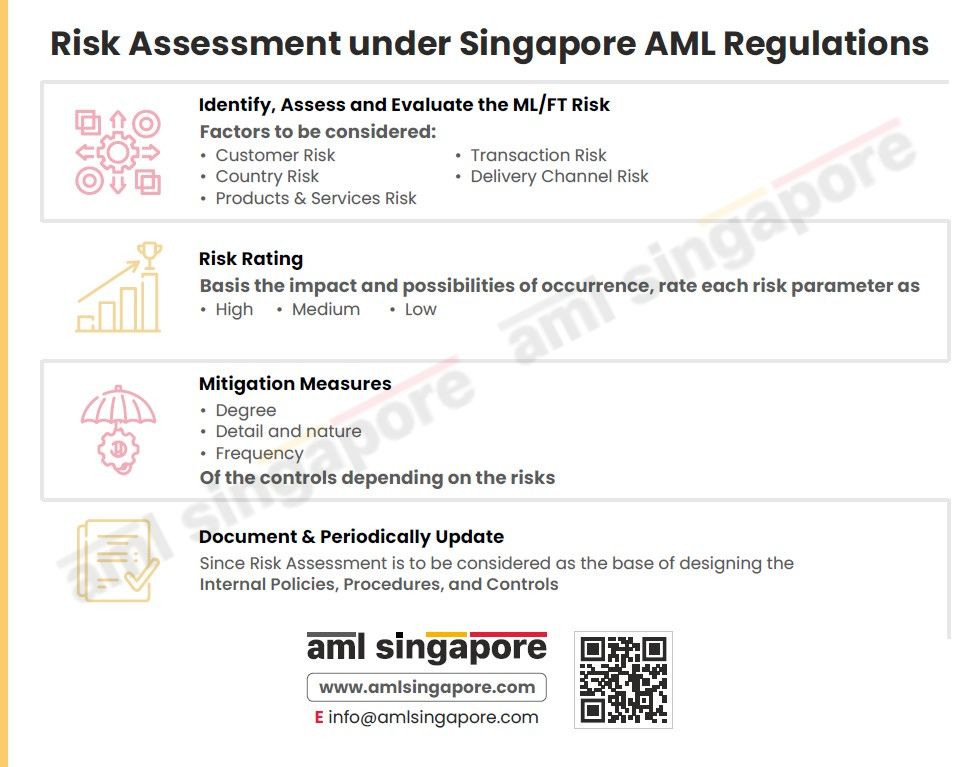

Singapore’s AML regulations mandate the regulated entities to perform Enterprise-Wide Risk Assessment to identify the overall money laundering and terrorism financing risk its business is exposed to and adopt a risk-based approach to mitigate such financial crime risk.

While assessing the business risk, the entities must consider the relevant risk parameters, such as the type of customers, geographies, the nature of products and services, the size and complexities of the transactions, delivery channels involved, etc.

Having identified the risk scenarios, the entities must evaluate each risk factor’s possible impact on the business and its probability of materializing. Basis this evaluation, adequate risk scoring or rating must be assigned to each risk parameter as High, Medium, or Low.

The organizations must develop and implement appropriate mitigation measures based on identified ML/FT risks. The degree, nature, and frequency of AML/CFT controls must be proportionate to the assessed business risk (e.g., stringent controls for high-risk elements while simplified measures for low-risk scenarios).

The factors considered for risk assessment and the methodology adopted must be well-documented.

As the business operations are ever-evolving, the Enterprise-Wide Risk Assessment of the entity must also be dynamic, aligning with the entity’s ML/FT risk appetite and emerging risks.

An accurate risk assessment sets the right foundation for the regulated entity to establish and maintains its Internal Policies, Procedures, and Controls (IPPC).

AML Singapore is an AML Consulting firm offering end-to-end AML compliance support to businesses in Singapore to identify and mitigate ML/FT risks. We assist companies in Enterprise-Wide Risk Assessment and customizing the IPPC based on assessed ML/FT risks.