Enhanced Customer Due Diligence under Singapore AML regulations

Enhanced Customer Due Diligence under Singapore AML regulations

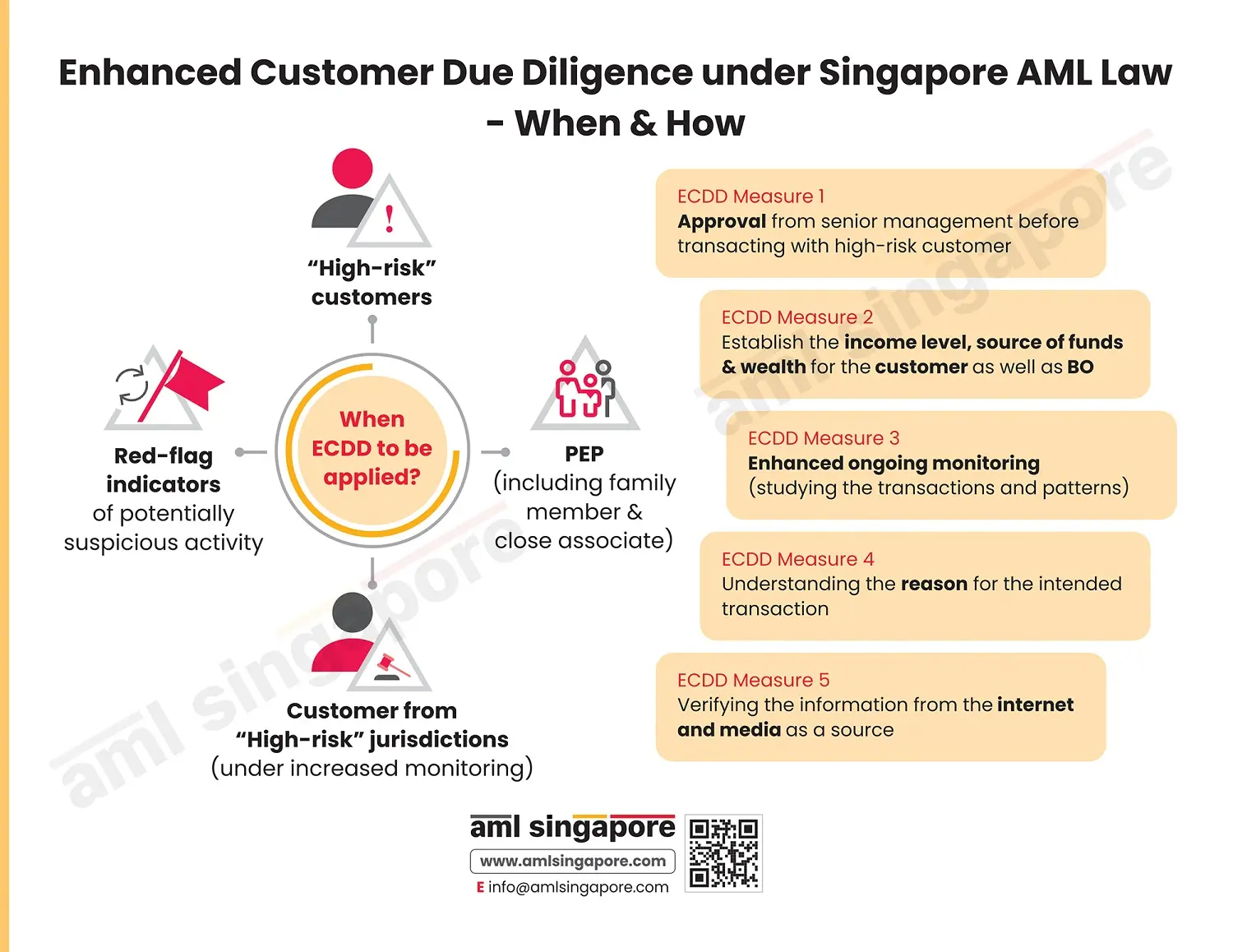

The AML regulations in Singapore provide for adopting a risk-based approach, wherein higher AML checks and measures are to be applied when the risk posed by the customer is high. Accordingly, when the customer is classified as posing a higher ML/FT risk to the business, the regulated entities must apply Enhanced Customer Due Diligence (EDD) measures.

Further, Enhanced Due Diligence Singapore (EDD) shall be applied when dealing with a Politically Exposed Person (PEP) or a customer coming from or having close association with a “high-risk jurisdiction” with weaker AML/CFT controls.

While performing Enhanced Customer Due Diligence, the regulated entities must establish the legitimacy of the customer’s income level, source of funds and wealth, understand the transaction’s purpose, obtain senior management’s approval before dealing with such high-risk customers, etc.

Here is an insightful graphic depicting the scenarios where the AML enhanced customer due diligence will be performed and enhanced due diligence requirements.

AML Singapore is a part of the global AML consultancy firm – NIYEAHMA Consultants LLP – offering comprehensive AML support to regulated entities. AML Singapore focuses on Singapore laws and entities, providing AML services around customizing the AML policy and procedures, AML training the team to implement the same effectively, etc.