Transactions where Customer Due Diligence is required under Singapore AML regulations

Transactions where Customer Due Diligence is required under Singapore AML regulations

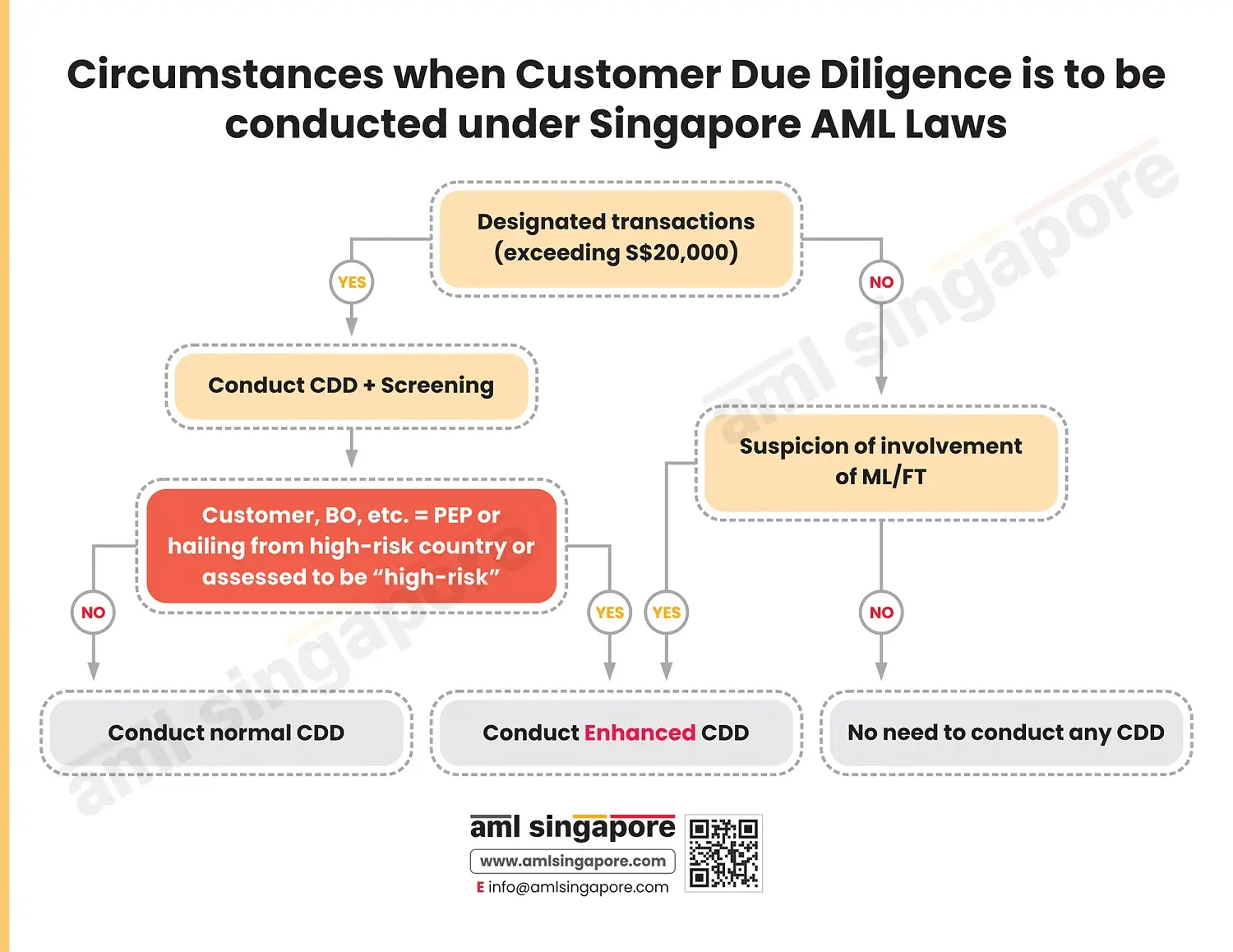

AML regulations in Singapore provide for the mandatory performance of Customer Due Diligence measures under specific circumstances. This includes instances where designated transactions exceed S$ 20,000. The exception is that the regulated entities are required to adopt Enhanced Customer Diligence measures when the customer or their Beneficial Owners are politically exposed person, or closely associated with high-risk countries, or has been assessed as posing high “ML/FT” risks to the business.

However, when any suspicion suggests the connection with money laundering or terrorism financing crime, the regulated entities must apply Enhanced Customer Due Diligence measures, irrespective of the amount involved.

Here is a graphical representation of the circumstances where the regulated entities are required to apply CDD measures, including transactions or customers requiring the application of enhanced measures (EDD).

AML Singapore offers end-to-end AML consultancy services to regulated entities in Singapore, including designing the framework for Customer onboarding and adequately applying the Customer Due Diligence process.